Autumn has arrived and it would be wonderful if we could say that the worst of 2022 is now behind us. We can’t, we don’t know and indeed nobody knows. July and much of August saw a little bounce which was extremely welcome and cheering. This was substantially based on some better economic news coming out of the US. We continue to be bombarded by noise, much of it conflicting. Two recent articles in The Telegraph on consecutive days read” Inflation may have peaked –” and then next day “UK inflation to almost double, economists warn” The reality is that both are most likely to be wrong.

Recent days have seen the positive sentiment change. We experienced a day in the last full week of August which recorded the biggest one day fall in US markets since June. On the same day Citibank suggested that inflation in the UK could reach almost 19% in January and interest rates would need to rise to around 7%. Oh, and the wholesale gas price shot up too following comments from Russia about supply to Europe. Recession fears continue to dominate as do serious inflation concerns. Traditional interest rate policy levers will be in conflict. Lower rates to head off a recession, raise interest rates to fight inflation.

The pandemic has not gone, Ukraine is still under siege. At home the UK’s major container port is on strike, the railways are striking, postal workers, criminal barristers, refuse collectors are striking too, and many others are considering industrial action whilst the cost of living seems to soar day by day with every news bulletin reminding us that staying warm over winter will be unaffordable and indeed will put a large part of the population at serious risk. It is a very grim outlook over the months ahead. Unsurprisingly, markets reflect these concerns and lack confidence which in turn creates huge uncertainty which then creates volatility and wild price swings.

Eventually, this storm will pass. How soon or how long is impossible to judge. A solution to the war in Ukraine would be a massive step towards some overdue respite, but it would be quite wrong to assign the whole blame of the global economic woes to that horrendous war. Energy issues were around from late summer last year and inflation was very much here, but many thought transitory and manageable by central bankers. Inflation would seem to be much stickier than many thought, and perhaps a consequence of unravelling the pandemic support and indeed the longer-term quantitative easing.

As the Chairman of Ruffer recently said “The old timers amongst us are now a treasured breed given our first-hand memories of living through a time when money routinely lost value: in the UK, the 1970s were such a period. In markets that were shot through, fair value was an aspiration, not a floor. It was also the start of a preference for the good company, rather than the great one. We are currently faced, as all investors are, with every asset class under pressure, and cash on deposit still yielding next to nothing. It’s the hardest year in a long while to achieve what we set out to do. That’s just the way it is, and we’ll do our best”.

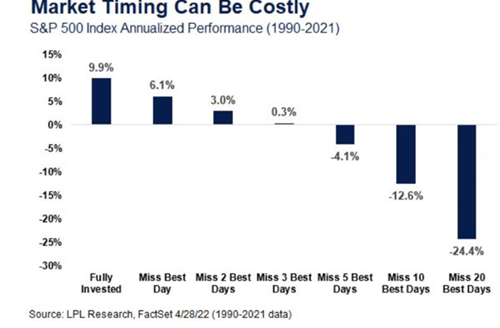

What is often forgotten in times such as these, is that the funds in portfolios are funds for the long term. None of the funds has an objective to return a positive outcome over months. Most set out to deliver positive returns over 3-5 years and indeed some are longer than that. 7 or 10 years is not unheard of. Retirement portfolios are built for the long term and should be judged over the long term. 3 years should be the minimum and 5 years would not be unreasonable. If you believe you can jump in and out of the market, then read no further. The chart shows what happens if you miss the key days over the long term. It very quickly becomes destructive.

Many investors must be thinking that they should have moved into cash whilst the storm sweeps across markets. It is a very understandable sentiment. We have for some time assessed short term cash requirements for those drawing an income and as no fund that we know of has an objective that can be measured in months, cash is a suitable home. We tend to park around 1-2 years cash requirements in a cash fund as broadly history suggests market and portfolio recovery is on average slightly less than that after a sell off.

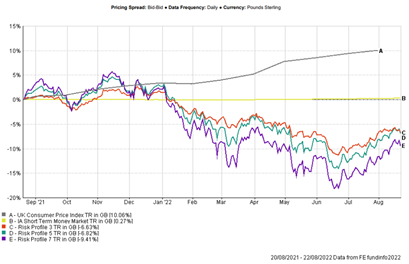

In the charts below we show three risk rated portfolios, risk 3, 5 and 7 over 12 months, 3 months, and 3 years. In the first chart selling up and going to cash 12 months ago would have beaten the portfolios, which have been battered by an array of global events. Neither cash nor the portfolios managed to beat inflation over the last 12 months. Inflation now running at levels not seen for 40 years or more, substantially driven higher by the energy crisis. So those that timed the market 12 months ago are ahead.

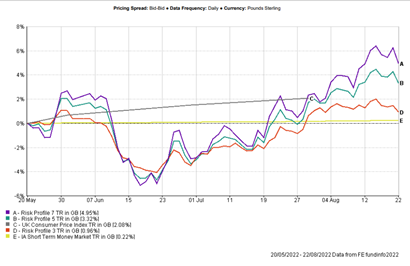

Over the last three months as more data emerges which is viewed as positive, we see markets recover a little of the lost ground. Cash remains static and despite the elevated rate of inflation, two of the portfolios make some headway and beat both CPI and cash over a far from straightforward period. Those out of the market have missed several good days that are so vital to achieving positive returns.

It is never plain sailing and as earlier noted the end of August saw a decline as worries surfaced yet again.

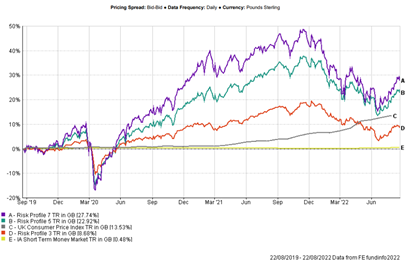

As long-term investors, we should look at least three years to see whether the cash strategy is rewarded.

Over 3 years the lowest risk rated portfolio beat cash by around 8% and the higher risk portfolio by around 27%. The lower risk portfolio up until the spring of this year was beating inflation but as inflation has surged, is now lagging but remains significantly ahead of cash.

Fund managers have a high conviction that portfolios will perform over the longer term, and we must remain patient and try to remember that short term news is unsettling but long-term performance is what matters. Maybe of course this time it would be different…

The above article is intended to be a topical commentary and should not be construed as financial advice. Past performance is not an indicator of future returns. Any news and/or views expressed within this document are intended as general information only and should not be viewed as a form of personal recommendation.